Classic Slots, eller klassiska spelautomater som man även kan säga på svenska, heter som de gör av bra anledning. Dessa slots är världens allra första spelautomater. Det har nu gått mer än 100 år sedan de uppfanns, men de anses fortfarande vara ett av världens mest populära hasardspel och är de spel som spelas mest både på etablerade som Mr Green och nya casino online enligt denna artikel.

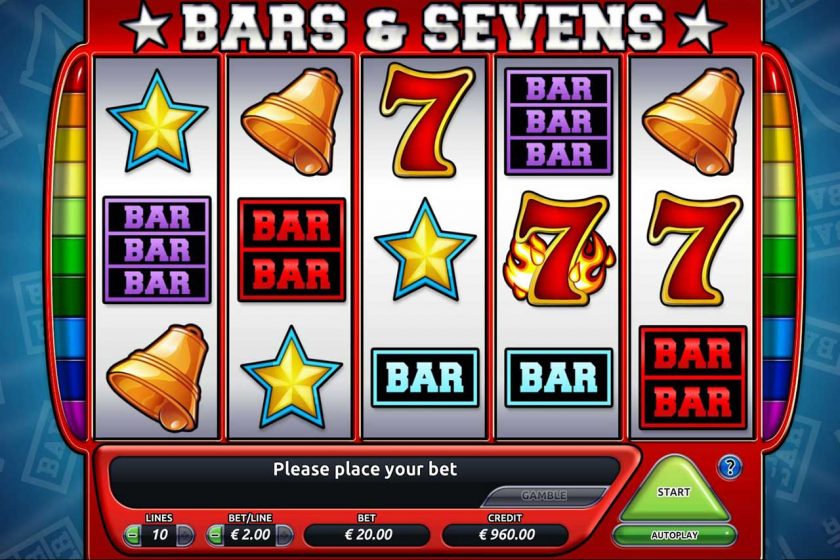

Det finns inte många kasinon som inte erbjuder sina besökare och spelare möjligheten att spela Classic Slots i deras lokaler eller på deras online casino sajter. Classic Slots är spelautomater med 3 hjul, olika antal linjer att välja mellan och olika myntstorlekar att välja mellan (mellan $0.25 och $5.00 per snurr). Till skillnad från video slots vinner spelare i dessa slots vanligtvis om de lyckas rada upp 3 eller 5 symboler på linjerna som enligt utbetalningstabellen ska betala ut en viss summa pengar. Satsningarna som görs i Classic Slots brukar vara mycket mindre än de som görs i video slots eftersom man oftast satsar på ett mindre antal linjer.

Tror du personligen att Classic Slots är urmodiga och något som folk snart kommer att tappa intresse för helt? Tycker du att sådana spel är tråkiga och varken lockar spelare som vill ha roligt eller spelare som vill lämna ett kasino eller online casino med betydligt mer pengar än han eller hon kom dit med? Om du tror det så har du fel! Klassiska slots är nämligen fortfarande riktigt aktuella, och detta är något som lär vara fallet i många år til. Classic slots kanske inte verkar lika spännande som kasinospel som black jack (till exempel), men de är utan tvekan minst lika underhållande som alla andra casinospel som går att spela på online casino.

Vad är en Classic Slot? Jo, det är helt enkelt en spelmaskin med tre hjul och en linje. Som du kanske vet så är det allt fler spelautomater idag som erbjuder spelare möjligheten att spela med 5 hjul och 15 linjer (eller till och med fler i vissa fall). Trots att de mer avancerade spelautomaterna är otroligt underhållande på sina egna sätt så betyder detta förstås inte att man bara ska glömma Classic Slots. De som är nya till att spela på online casino kanske direkt bläddrar förbi dessa kasinospel när de letar igenom spelutbudet på sitt valda online casino på grund av att de ser lite för enkla ut. Men låt dig inte luras av detta – om du inte testar att spela klassiska spelautomater så har du verkligen missat något!

I varje spelautomat är spelets mål att träffa särskilda symbolkombinationer. Om du lyckas matcha dessa symboler så har du vunnit. Innan du börjar spela Classic Slots så kan det löna sig att först kolla på utbetalningstabellen för att se till att du har koll på exakt vad du vinner om du träffar olika symbolkombinationer. Vilka tre symboler behöver du till exempel träffa för att vinna spelets jackpot?

Det är säkert många som skulle vilja påstå att spelautomater är tråkiga, men de kanske inte vet om att dessa kasinospel oftast har funktioner som gör spelen mer intressanta. Vissa Classic Slots har unika funktioner som multiplikatorer, wild-symboler, scatter-symboler och bonusspel.

Så bli inte alltför förvånad om du börjar spela Classic Slots och väldigt snabbt blir helt fast vid att spela dessa spännande spel! Detta casino spel passar spelare som föredrar enkla spel. Classic Slots spelas som sagt bara med en linje och tre hjul, så det är omöjligt att råka göra fel när man spelar. Man kan helt enkelt bara sätta sig framför datorn, logga in på något av nätets bästa casinon, börja spela slots av detta slag, snurra hjulen och slappna av. Det krävs inte att du anstränger dig för mycket, men du kommer garanterat att ha riktigt roligt.

Var går det att spela Classic Slots? Ja, i stort sett överallt! Dessa går att spela på nästan alla online casino sajter på nätet, och i alla fall på de bästa online casino sajter på internet. Det är nog tveksamt att du hittar ett riktigt kasino som inte erbjuder dig möjligheten att spela Classic Slots. Personligen tycker jag att det är roligare att spela Classic Slots på online casino eftersom de har ett mycket större utbud av olika spelautomater i olika teman, och på grund av att man kan spela gratis slots online. Du kan alltså testa att spela utan att satsa riktiga pengar.

Roulette är ett mytomspunnet spel, från början kallade man det för Djävulens spel av den enkla anledningen att om man lägger ihop alla nummer som hjulet innehåller (0-36) så bildar de summan 666. Idag vet man förstås bättre, roulette är ett av de spel som drar flest spelare på ett casino, oavsett online eller landbaserat. Spelet är turbaserat till skillnad från

Roulette är ett mytomspunnet spel, från början kallade man det för Djävulens spel av den enkla anledningen att om man lägger ihop alla nummer som hjulet innehåller (0-36) så bildar de summan 666. Idag vet man förstås bättre, roulette är ett av de spel som drar flest spelare på ett casino, oavsett online eller landbaserat. Spelet är turbaserat till skillnad från

Blackjack är ett mycket populärt kortspel, om kanske inte det mest populära på nätcasinon. Det här spelet hittar man också på många andra ställen, hos t.ex pubar och krogar brukar det vara ett vanligt och mycket uppskattat inslag precis som

Blackjack är ett mycket populärt kortspel, om kanske inte det mest populära på nätcasinon. Det här spelet hittar man också på många andra ställen, hos t.ex pubar och krogar brukar det vara ett vanligt och mycket uppskattat inslag precis som